Trading using Technical Indicators on Blueshift®¶

What are technical indicators¶

Technical indicators are, in general, functions of price and volume of underlying securities1. There are many indicators - essentially differing in their functional forms. However, most indicators can usually be expressed as a function of returns of the underlying. For example, the moving average cross-over indicator is the difference in two different moving averages of price. This can be expressed as mom=\sum_{i=0}^{n_1} a_i.P_i - \sum_{i=0}^{n_2} b_i.P_i where n_1 and n_2 are the short and long moving average periods, a_i and b_i are weights for the price points (for simple moving averages a_i=1/n_1 etc.) and P_is are the price points. It can be shown2 that this can be expressed in terms of price returns, as mom=\sum_{i=0}^{n} w_i.r_i, where r_i=P_i - P_{i-1} and n=n_2 from above. The r_is are returns, if we assume P_is are log prices. Similar treatment can be applied to other indicators, a few examples below

Momentum cross-over: \sum_{i=0}^{n} w_i.r_iMACD histogram(MACD line - signal line): \sum_{i=0}^{n1} w_i^1.r_i - \sum_{i=0}^{n2} w_i^2.r_i\Rightarrow\sum_{i=0}^{n} w_i.\Delta{r_i} , here \Delta{r_i}=r_i - r_{i-1}CCI:\frac{1}{\sigma}\sum (P_i - \bar P)\Rightarrow\frac{1}{n.\sigma}\sum (r^{n}+r^{n-1}+..+r)\Rightarrow\sum w_i.r_i where r^k = r_i - r_{i-k}

Nature of technical indicators¶

While most indicators can be expressed as a function of returns, not all of them are linear (or even polynomial) as above. Broadly, we can divide all common technical indicators that can be expressed as function of returns in three different classes:

- Indicators that are linear (or polynomial) combination of past returns in returns space (f(r)). Examples - the ones above. Under certain condition (stationarity) they can be modeled as Gaussian distribution

- Indicators that are functions of sign of the returns in signed returns

space (f(r^+, r^-)). Examples - like

RSIorChande Momentum Oscillator. They can be analyzed using folded normal distribution - Indicators that are function of returns in time space (f(t(r))). An

examples is the

Aroonindicator.

Different indicators may have significant commonalities - given they

all are essentially

filters

over the prices (and volumes). However, the

response characteristics of their filtering method may differ, based on

the functional form, as well as the parameters used (e.g. lookback etc).

MACD, for example is more mean-reverting (i.e. suitable for short term

trends) compared to momentum cross-over with similar parameters. Also

increasing the lookback periodicity for most indicators will make them less

sensitive to short term fluctuations.

A simple strategy¶

Let's implement a simple technical indicators based strategy on Blueshift®. It is based on simple moving averages and bollinger band.

We buy (sell) if the close price is near lower (upper) bands. If price is away from either extreme we buy (sell) if momentum cross-over is positive (i.e. short term moving average is higher than long term one).

Implementing technical indicators¶

On Blueshift®, the easiest way to implement any common technical

indicator is using the talib library.

This

is a Python wrapper for the c-library TA-lib.

Note

Most of the functions in talib will accept a single (or multiple)

numpy array as inputs. The data functions

on Blueshift® will usually return a Pandas series or

dataframe. To use the data, use the values attribute of Pandas

object to access the underlying numpy array.

The basic code snippet looks like below:

# import talib

import talib as ta

# inside some functions like handle data

px = data.history(symbol("AAPL"), "close", 100, "1d")

upper, mid, lower = ta.BBANDS(px.values)

Creating our own technical indicator library!¶

If we plan to use technical indicators heavily in our strategy code, it

perhaps make sense to create a re-usable library in our workspace. Create

a directory at the top level of your workspace

named library (if it is not already there). Inside that directory,

create another directory named technicals (of not there already).

Create a source file named indicators, using any template, under the

directory technicals. Click the source to open in the code

editor and delete the existing code. Copy the content of

from here

and paste it in the code editor. Save and go back to workspace root.

Now we have a library with a useful bunch of technical indicators ready

to be used in our code anywhere with a single line of code

from blueshift_library.technicals.indicators import macd

Creating the strategy¶

Now we get our hands dirty to code the strategy. Create a source file

anywhere in your workspace, using the Buy and Hold (NSE) template. Open

it in code editor (by clicking it). This template already includes most

of the import we required. Let's add an import statement at the very top

to include our own technical indicator library we just created. We

also import commission and slippage to set them to zero in our

demo strategy.

from blueshift_library.technicals.indicators import bollinger_band, ema

from blueshift.finance import commission, slippage

Let's now delete everything from the initialize function in the

template and below.

Defining the initialize function¶

Now let's overwrite the initalize function to look like below

def initialize(context):

# universe selection

context.securities = [symbol('NIFTY-I'),symbol('BANKNIFTY-I')]

# define strategy parameters

context.params = {'indicator_lookback':375,

'indicator_freq':'1m',

'buy_signal_threshold':0.5,

'sell_signal_threshold':-0.5,

'SMA_period_short':15,

'SMA_period_long':60,

'BBands_period':300,

'trade_freq':5,

'leverage':2}

# variable to control trading frequency

context.bar_count = 0

# variables to track signals and target portfolio

context.signals = dict((security,0) for security in context.securities)

context.target_position = dict((security,0) for security in context.securities)

# set trading cost and slippage to zero

set_commission(commission.PerShare(cost=0.0, min_trade_cost=0.0))

set_slippage(slippage.FixedSlippage(0.00))

Here we set our universe as NIFTY-I and BANKNIFTY-I, the first

futures on the indices. We

also create a 'dictionary' to save all our strategy parameters and save

it as an attribute of the special context object as context.params.

This is a good practice to keep all parameters at one

place. We also initialize a variable context.bar_count to keep track

of the bars - this is required as we want to trade only every 5 minutes,

but the platform will trigger our handle_data function every minute.

We then initialize two Python dictionaries to keep track of the

signals generated and target positions for each asset in our universe.

Finally, we set the trading commissions and slippage to zero, to capture the pre-cost performance of this strategy.

Note

Here we are setting the trading commissions and slippage to simulate trading conditions in a backtest. In case of live trading these functions are meaningless, as the actual slippages and commissions are beyond out control.

Defining the handle_data function¶

Our handle_data function is relatively simple. It looks like below

def handle_data(context, data):

context.bar_count = context.bar_count + 1

if context.bar_count < context.params['trade_freq']:

return

# time to trade, call the strategy function

context.bar_count = 0

run_strategy(context, data)

trade_freq, in minutes), we call our main trading

function run_strategy. Let's see how this function looks like.

Coding the core strategy¶

The run_strategy function consists of three calls to three other

functions. First we generate signals for each of the asset in our

universe using the generate_signals function. This function updates the

signal tracking variable context.signals. Then we compute the target

position for each asset, based on the signal and our threshold values (

parameter buy_signal_threshold and sell_signal_threshold). In general,

the target positions can depend on many other variables, like the recent

profit and loss of our strategies, cash left in the account and so on.

We keep it very simple here for this demo strategy. Finally, we call our

rebalance function, which is an execution function that carry our the

target positions by sending orders to the broker (backtest engine in

this case). The function run_strategy looks like below

def run_strategy(context, data):

generate_signals(context, data)

generate_target_position(context, data)

rebalance(context, data)

The rebalane function¶

The rebalance function is the simplest, it looks like below

def rebalance(context,data):

for security in context.securities:

order_target_percent(security, context.target_position[security])

for loop.

The target position function¶

Next function is the generate_target_position function, that looks like

below:

def generate_target_position(context, data):

num_secs = len(context.securities)

weight = round(1.0/num_secs,2)*context.params['leverage']

for security in context.securities:

if context.signals[security] > context.params['buy_signal_threshold']:

context.target_position[security] = weight

elif context.signals[security] < context.params['sell_signal_threshold']:

context.target_position[security] = -weight

else:

context.target_position[security] = 0

weight with the underlying signals for the

asset, to arrive at the portfolio weights w_i, and store it in the

weight tracking variable context.target_position.

Generating the signal¶

The signal generating function is also relatively simple. It fetches

data for the assets first. Then in a for loop

it extract the data for the particular asset and passes on to the

signal_function.

def generate_signals(context, data):

price_data = data.history(context.securities, 'close',

context.params['indicator_lookback'], context.params['indicator_freq'])

for security in context.securities:

px = price_data.loc[:,security].values

context.signals[security] = signal_function(px, context.params)

The main signal function¶

The heart of the strategy is here. This generates the signal for each asset using our strategy logic. This looks like below:

def signal_function(px, params):

upper, mid, lower = bollinger_band(px,params['BBands_period'])

ind2 = ema(px, params['SMA_period_short'])

ind3 = ema(px, params['SMA_period_long'])

last_px = px[-1]

dist_to_upper = 100*(upper - last_px)/(upper - lower)

if dist_to_upper > 95:

return -1

elif dist_to_upper < 5:

return 1

elif dist_to_upper > 40 and dist_to_upper < 60 and ind2-ind3 < 0:

return -1

elif dist_to_upper > 40 and dist_to_upper < 60 and ind2-ind3 > 0:

return 1

else:

return 0

bollinger_band and ema to get the

indicators. We compute a variable named dist_to_upper capturing the

current close price distance from the upper band. If it is too high (i.e.

close to the upper band) we send a sell signal (-1), if it is too low (

close to the lower band) we buy. If neither, we use the short and long

moving average cross over signal (ind2-ind3 above) to determine our

position. Else we go flat (0).

Running a quick backtest¶

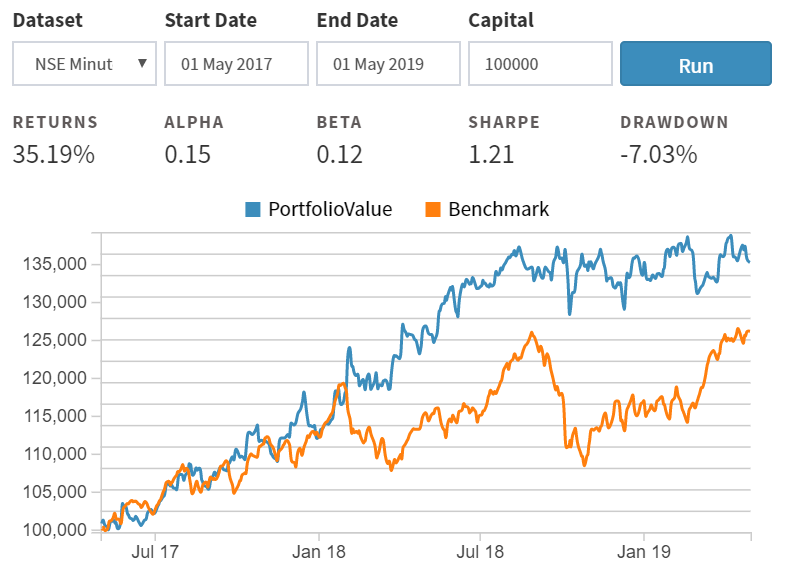

Now that our strategy is done, let's hit the quick run button, selecting

NSE Minute as our dataset and date range as 1st May 2017 to 1st May

2019 and capital at 100,000. The result looks like below:

For more details, we can go and run the full backtest.

More technical strategies¶

The strategy above is quite general for implementing any technical

indicator based strategy. As we see the core logic is implemented in

the signal_function. By simply altering this function we can create

a range of different strategies with different indicators or combination

of them. For more examples of such strategies please visit our

demo

page on Github.