Creating Your First Strategy on Blueshift®¶

A simple strategy¶

The strategy we are going to implement is a simple buy and hold. We buy a specific stock, investing 50% of our portfolio value (rest remains in cash). We continuously monitor the position value to keep this percentage constant at 50%. If the stock rallies, we sell some of it. If the stock price goes down, we buy more of it to achieve the 50% target. We start with an initial amount of capital and are interested to check how this simple scheme (with a twist of mean-reversion) holds up, starting from January 2019, till date.

Creating a new strategy¶

Once you log in, you will land up in the main strategy list page at

/research. Click on the

button. On the dialog box, create a new folder named

button. On the dialog box, create a new folder named example. Click to

go inside this folder. Then hit the

button. Name the strategy as

button. Name the strategy as buy_and_hold, select Buy and Hold (NYSE)

for the template (doesn't matter, we will erase all template codes later).

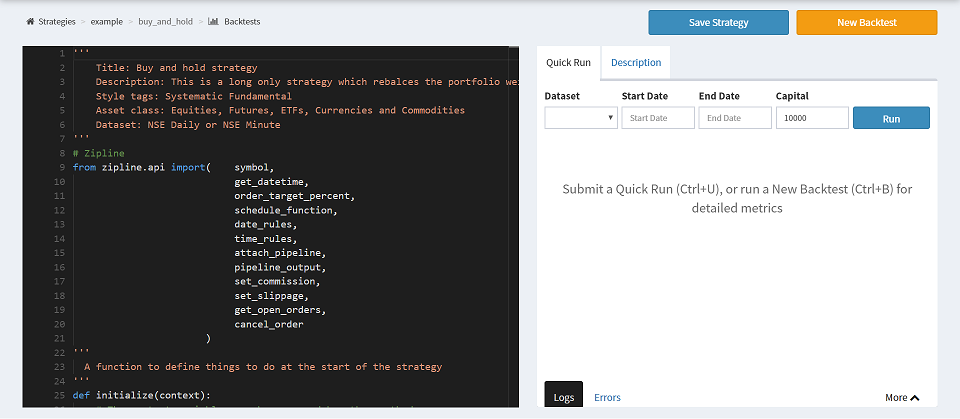

You will land up in the strategy page as shown below.

The black editor area

is our code editor.

The strategy code¶

Let's now delete the entire pre-filled template code and copy-paste the

following snippet in the code editor.

from blueshift.api import symbol, order_target_percent

def initialize(context):

"""

called once at the start of the run.

"""

# convert the symbol string to asset and store a reference to it

context.stock = symbol('AAPL')

def handle_data(context,data):

"""

called every 'bar' (minute or daily depending on the data

frequency).

"""

# order to target 50% of portfolio value in the asset

order_target_percent(context.stock, 0.5)

What is happening here? We first begin with importing some functions we

are going to use from the core engine. We use two API functions -

symbol and order_target_percent. The first one takes in a string and

returns an asset object understood by the engine. The second one is an

automatic order sizing function - takes in an asset and a target percentage number,

and computes the number of units we need to buy and sell, so that we are

at our target investment of 50% of the portfolio value.

We save the asset reference within a function called initialize.

It is a special function. Once you run the strategy, the platform will

automatically look for this function in your strategy code and run it only

once - at the very beginning. The actual trading happens within another

such special function called handle_data. This function is called by the

platform at every time bar (every minute or daily, depending on the

input data frequency).

Running backtests¶

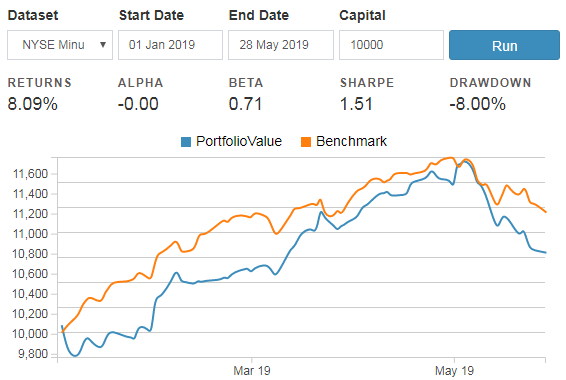

Fill in your backtest parameters in the input fields (dataset, start date,

end date and initial capital). We must choose a dataset that

contains the assets we have in our code, in this case let's go with the

US Equities dataset (where AAPL trades). Choose the start date as 1st

January 2019, and then pick the last available date for end date. Leave

the capital at default 10,000 dollars. Now hit the

button on the right (or the shortcut

button on the right (or the shortcut Ctrl+U). This will start the quick

backtest, streaming the results along with some basic performance metrics.

You can continue to work on the code while it runs.

You can also run a full-fledged backtest by hitting the

button.

Full backtest runs in the background, and you will see a notification (

button.

Full backtest runs in the background, and you will see a notification (

on top right.)

when it is ready. Click (or follow the

on top right.)

when it is ready. Click (or follow the bread-crumb) to go to the backtest

page (you can also click the

button on the backtest page) once the status is complete. A full backtest

report has a much richer set of details of the simulation, including

transactions history.

button on the backtest page) once the status is complete. A full backtest

report has a much richer set of details of the simulation, including

transactions history.

Going live¶

Move on to the live trading section!