Factor Based Strategies on Blueshift®¶

What is a factor¶

Market theories1 tell us that returns of any stock can be explained by a set of hidden variables, plus a residual bit unique to that stock. Usually, we take overall market returns as the sole explainer. In this world, the value investor's job is to find stocks with high expected residual returns, assuming valuation measures can capture it. It turns out parts of this residual can be further explained by other fundamental characteristics of the stock. If they are stable and consistent, each of such characteristics can be thought of as a risk factor. In such a world, an investor's job is to identify factors with high expected returns and design portfolios to capture them. This is, in a nutshell, the essence of factor investing. We systematically probe the drivers of the markets, instead of taking concentrated exposure on idiosyncratic risks.

The maths of factor models¶

The Capital Asset Pricing Model1 tells us the expected returns of a stock can be expressed as

Here \mathop{\mathbb{E}} is the expectation operator, R the stock returns, R_{f} the risk-free return, R_{M} the returns of the market portfolio, and \beta is the sensitivity of R to R_{M}. The realized returns under this model is then

Here \alpha is the returns not explained by the market factors and \epsilon is a zero-mean stock specific innovation (also known as idiosyncratic risk). All factor models extend this basic equations ( expected and realized returns) respectively as below

These are with similar interpretation. The \alpha_{F} and \epsilon_{F}

are same as \alpha and \epsilon as above, accounting for the extra

factors (in addition to the market factor R_{M}-R_{f}). \Delta F_{k}

is the realized change in the factor, and

\mathop{\mathbb{E}}\Delta F_{k} is the expected change, also known as

the risk premium. beta_{k} is the sensitivity (loading) of the

asset to the particular factor k.

The objective of all factor models is to find a set of factors F_{k}s such that the factor sensitivity as well as the risk premia are stable and predictable. Such strategies, when properly designed, can extract the returns (as a result of exposure to the factors risk) over and above the market returns. Most of factor research revolves how to find, evaluate and verify such factors, and how to build portfolios to control exposure to a particular factor or a set of factors.

The cross-sectional momentum factor¶

Factor investing is an active area of investment research. Apart from the market factor, there are many other factors proposed in many research papers since Fama and French 2 first came up with their three factor model. One such time-tested factor is the cross-sectional momentum factor, first scrutinized by Jegadeesh and Titman 3. The strategy is as follows:

- Rank all assets in the universe based on their past returns.

- Buy the top x-percentile and sell the bottom x-percentile (even if they are going up in prices).

- Rebalance after a specified holding period

The past returns are typically computed for 1 year, one month prior to rebalance. Holding period is typically one month. It is also common to apply a liquidity filter to the asset universe to weed out illiquid stocks which may skew the factor exposure.

Creating a custom pipeline package¶

If you have gone through the previous section, this

strategy looks like a perfect fit for using pipeline. We are first

going to create a custom pipeline package just like we did in our

technical indicator tutorials.

As usual, we create a directory at the root of our workspace named

pipelines, and inside that directory create a source file (using

any template, we will be deleting all template codes) named pipelines.

Copy the code from

here

and paste it in the new source file, overwriting all existing contents.

Save and go back to our workspace. Our custom pipeline library is

ready!

The factor computation¶

If we take a look at the file we just created, we will find a function

called period_returns. This is the function that computes our factor.

The function looks like below:

def period_returns(lookback):

class SignalPeriodReturns(CustomFactor):

inputs = [EquityPricing.close]

def compute(self,today,assets,out,close_price):

start_price = close_price[0]

end_price = close_price[-1]

returns = end_price/start_price - 1

out[:] = returns

return SignalPeriodReturns(window_length = lookback)

compute function. The only input is close price. We simply calculate

the returns over the periods and assign it to our out variable.

Another filter function we will use is a volume filter, which we have

already seen before once.

Implementing the strategy¶

Let's now create a new source anywhere in our workspace from one of the

Buy and Hold templates. Let's add the following line to the top before

all imports, to import the functions we need from our custom library we

just created.

from blueshift_library.pipelines.pipelines import average_volume_filter, period_returns

from blueshift.errors import NoFurtherDataError

NoFurtherDataError so that we

can catch when there are no data to be fed to the pipeline. Let's now

define the initialize function as below:

def initialize(context):

context.params = {'lookback':12,

'percentile':0.05,

'min_volume':1E7

}

# Call rebalance function on the first trading day of each month

schedule_function(strategy, date_rules.month_start(),

time_rules.market_close(minutes=1))

# Set up the pipe-lines for strategies

attach_pipeline(make_strategy_pipeline(context),

name='strategy_pipeline')

lookback for our

returns computation (12 months), volume filter (dollar volume greater

than 10 million) and percentile to group stocks to buy or sell (as

we shall see later). Then we schedule a function called

strategy to be called every month (matching the holding period). Finally

we build a pipeline in a function called make_strategy_pipeline (to

be defined later) and attach to our

strategy.

Building the pipeline¶

The pipeline building looks like below:

def make_strategy_pipeline(context):

pipe = Pipeline()

# get the strategy parameters

lookback = context.params['lookback']*21

v = context.params['min_volume']

# Set the volume filter

volume_filter = average_volume_filter(lookback, v)

# compute past returns

momentum = period_returns(lookback)

pipe.add(momentum,'momentum')

pipe.set_screen(volume_filter)

return pipe

pipeline, call upon or filter (

volume_filter) and factor (momentum) using our library functions we

just created, add the factor under a column (also named momentum),

and set the screen with the filter. Note, here we multiply the lookback

with 21, to convert from months to days.

Running the strategy¶

The main strategy function we scheduled is very simple:

def strategy(context, data):

generate_signals(context, data)

rebalance(context,data)

Computing the factors¶

This is done in the generate_signals function that looks like below:

def generate_signals(context, data):

try:

pipeline_results = pipeline_output('strategy_pipeline')

except NoFurtherDataError:

context.long_securities = []

context.short_securities = []

return

p = context.params['percentile']

momentum = pipeline_results.dropna().sort_values('momentum')

n = int(len(momentum)*p)

if n == 0:

print("{}, no signals".format(data.current_dt))

context.long_securities = []

context.short_securities = []

context.long_securities = momentum.index[-n:]

context.short_securities = momentum.index[:n]

pipeline

(see here) which computes the

result and return it in the array pipeline_results. We sort this array

(remember this array is indexed by the assets) by the factor column we

want (momentum in this case). We pick up the top p percentile of stocks

to buy (storing it in context.long_securities) and bottom p

percentile to short (context.short_securities). This is the classic

cross-sectional momentum strategy. Note, by design, we always have same

number of stocks to buy and sell, giving us a market neutral portfolio.

Carrying out the rebalancing¶

Finally we trade the securities in our long and short list in the

rebalance function:

from blueshift.api import order_target_percent

def rebalance(context,data):

# weighing function

n = len(context.long_securities)

if n < 1:

return

weight = 0.5/n

# square off old positions if any

for security in context.portfolio.positions:

if security not in context.long_securities and \

security not in context.short_securities:

order_target_percent(security, 0)

# Place orders for the new portfolio

for security in context.long_securities:

order_target_percent(security, weight)

for security in context.short_securities:

order_target_percent(security, -weight)

This function defines a base weight. Then it first check if we have

open positions in any stocks that are NOT in our current long or short

lists and close them out. We do that by querying the

special variable context. Then it loops through our long and short lists

and place new orders with the target weight with sign.

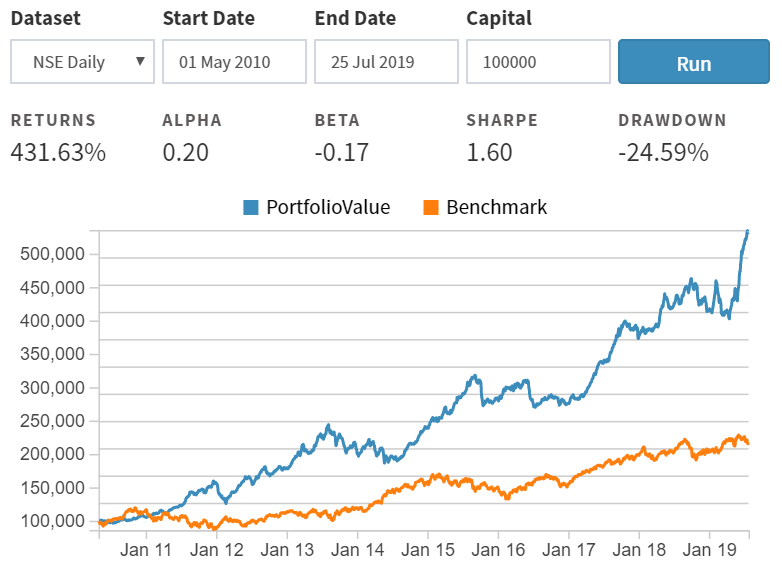

Running a quick backtest¶

Now that our strategy is done, let's hit the

quick run button, selecting

NSE daily as our dataset and date range as 1st May 2010 to 25th July

2019 and capital at 100,000. The result looks like below:

For more details, we can go and run the full backtest.

More factor strategies¶

Any factor based strategy can be implemented using the above guidelines.

We have to first define a factor function (like period_returns above)

and then can use the rest of the strategy code to implement it. This

function can be anything, as long as it returns a single numerical value

for each stocks. We rank our stocks based on that value, choose a long/short

portfolio based on this rankings and carry out the trades. For more

examples of such strategies please visit our

demo

page on Github. For a list of factor based strategies in equity markets

see

here.